extended child tax credit payments 2022

15 rounding out a six-month series of checks that supported an estimated 61 million American kids. A bill drafted by the Biden administration could cover back payments of the 2022 child tax credit.

Stimulus Update Could 300 Monthly Federal Child Tax Credit Be Made Permanent Cleveland Com

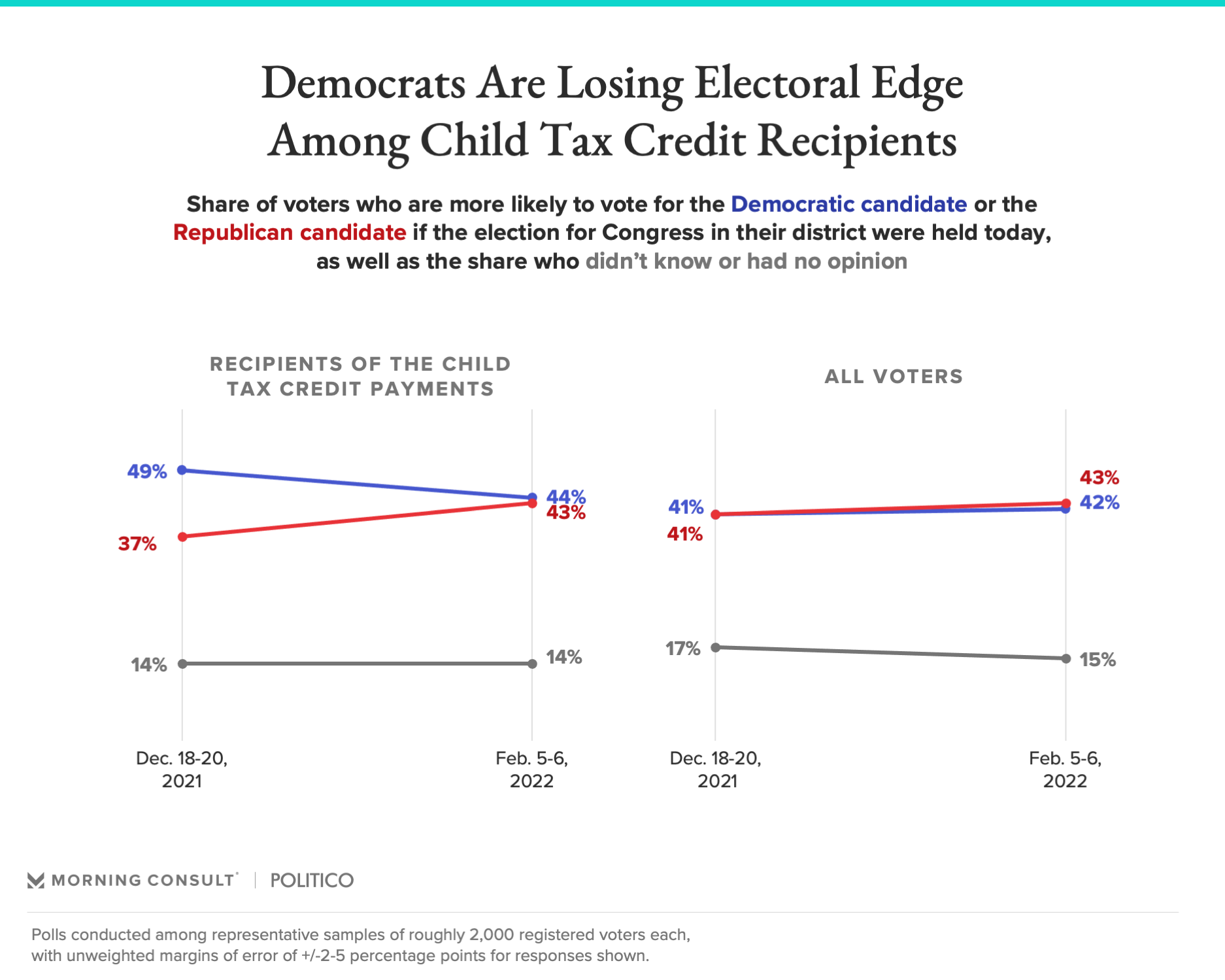

The assessment was based on a survey wave right after the final payment was received.

. For 2021 eligible parents or guardians can. The final advance child tax credit payment for 2021 is set to hit bank accounts on Dec. 31 2022 in his Build Back Better.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. However parents might receive one more big payment in April 2022 as part of last years plan. Leading the charge is President Joe Biden himself who included a proposal to extend the enhanced child tax credit through Dec.

Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Now if the current. However President Joe Biden s administration is.

Families saw the first half of the credit spread out in six. The payments wont continue in 2022 for the new year. New data reveals how badly families are hurting in the absence of the monthly payments they received during the.

The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17. For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. However President Joe Bidens administration is crafting a bill that would.

This means that next year in 2022 the child tax credit amount will return. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments.

Thus 3600 was offered for a child under the age of six and 3000 for children between the ages of six and 17. Making the credit fully refundable. As part of the American Rescue Plan Congress temporarily boosted the 2000 child tax credit to.

If lawmakers dont ever extend the expansion the child tax credit for 2022 would revert to its current law levels a maximum credit of 2000 per child under age 17 that phases. The CTC t is normally worth 2000 but last year it was 3600 for kids 5 and under and 3000 for kids ages 6 to 17. Many people want to know if the child tax credit is over or if it will get extended into 2022.

Moreover in the second half of 2021 it became possible to. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Making the credit fully refundable.

A childs age determines the amount. But others are still. In the meantime the expanded child tax credit and advance monthly payments system have expired.

Last year American families were thrown a lifeline in the form of the boosted Child Tax CreditIn 2021 the credit was worth up to 3600 for children under the age of 6 and. An increase in the maximum credit that households can claim up to 3600 per child age five or younger and 3000 per child ages six to 17. The boosted Child Tax Credit did not get extended for 2022.

31 2022 in his Build Back Better. Those payments ended in December and theres no indication yet that the child tax credit will be enhanced for 2022. In 2017 this amount was.

Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan. Bidens Build Back Better plan which would have included.

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

The Child Tax Credit Toolkit The White House

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Parents Guide To The Child Tax Credit Nextadvisor With Time

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Child Tax Credit 2022 Update Checks Up To 750 Being Sent See How Much You Ll Get Based On How Many Kids You Hav The Us Sun

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Filing Taxes

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

The Child Tax Credit Toolkit The White House

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

What Families Need To Know About The Ctc In 2022 Clasp

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Gauging The Impact Of The Expanded Child Tax Credit S Expiration